PensionBee: Combine Pensions 1.30.4

Free Version

Publisher Description

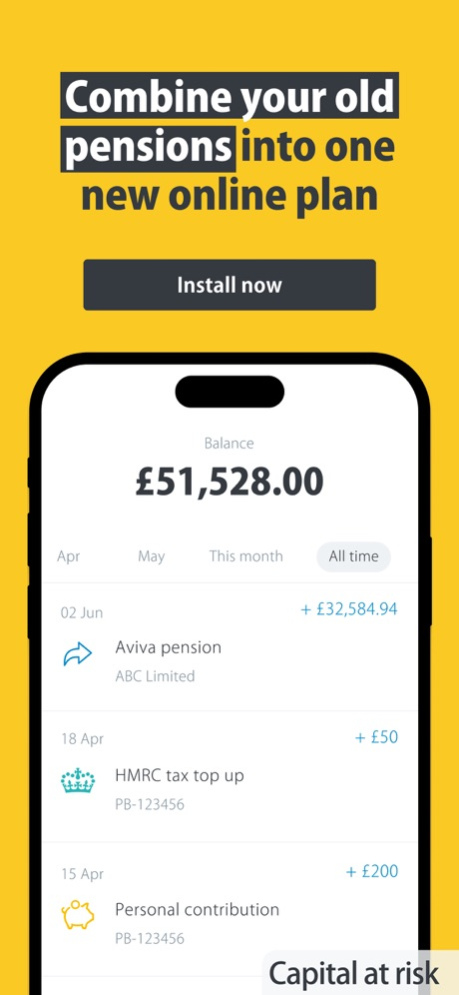

Combine your old workplace pensions and SIPPs into a new online plan so you can save for a happy retirement. Capital at risk.

Why choose PensionBee for your pensions?

1. A pension app built for the 21st century

2. Combine old pensions or start a self-employed one

3. Make contributions and withdrawals in our app or online - withdrawals from the age of 55 (57 from 2028)

4. Keep track of your pension balance 24/7

5. Award-winning customer service

6. Transparent - one simple annual fee

7. It’s easy to get started - sign up in the app.

A pension app built for the 21st century

• Avoid the paperwork - manage your pension through our app or website

• We aim to make pensions easy to understand by avoiding jargon

• Whether you have a workplace pension, own a limited company or are self-employed we can help you stay on top of your retirement savings

• Transfer old workplace, personal pensions and SIPPs

• An easy-to-understand online annual statement.

Combine your old pensions or start a self-employed pension

• Combine your pensions into one easy-to-manage pot

• Avoid separate management fees when you combine pensions, pay just one simple annual fee

• Self-employed and need a pension? Simply tap “Self-employed and don’t have a pension to transfer?” when signing up and adding a pension. You’ll then be able to open and add some money to your PensionBee account

• Choose from eight purpose-built plans including our Impact and Fossil Fuel Free plans for those interested in ESG and socially responsible investing. All are managed by some of the world’s largest and most experienced money managers. Switch plans at any time.

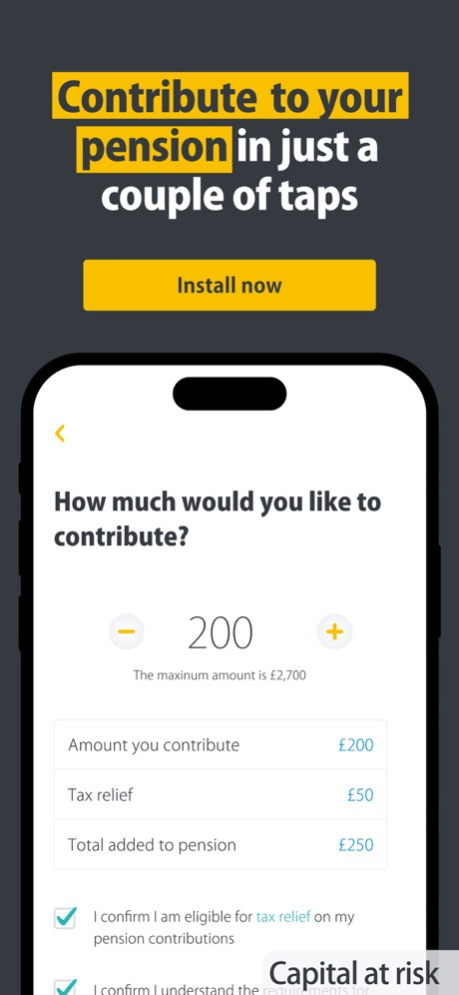

Contributions and withdrawals in the app or online

• Top-up your pension in just a few taps

• We’ll automatically claim your 25% tax top-up from HMRC on eligible personal contributions

• Make one-off or regular payments with no minimum contributions

• Skip the tedious paperwork by making withdrawals straight to your bank account digitally from the age of 55 (57 from 2028).

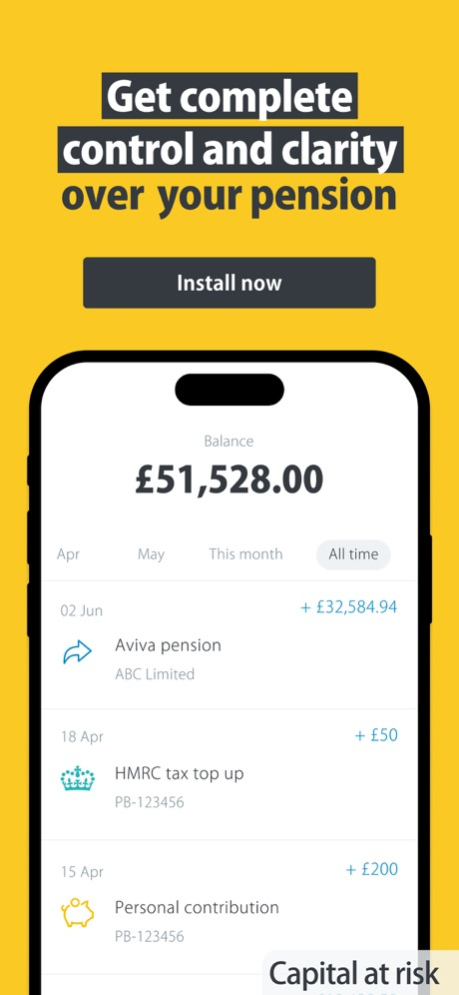

Stay on top of your pension

• Use our retirement planner to see what your retirement income could be and how much you need to save to reach your retirement goals

• Check your pension balance and track its performance 24/7

• Keep track of any outstanding pension transfers.

Friendly, award-winning customer service

• Get human support with your very own UK-based account manager

• Our BeeKeepers are on hand to look after you and your pension, from sign up to drawdown.

Transparent - no hidden fees

• Our plans have one simple annual fee ranging from 0.50% to 0.95%. We halve that fee on the portion of your pension over £100,000

• A withdrawal fee of £150 applies in certain circumstances; when accessing your pension within the first 12 months of being with us or if the value of your account’s less than £150 at the point of withdrawal

• There’s also a 30-day cancellation policy, which means we’ll return your pensions to your old providers free of charge - assuming they’re also willing to take them back.

FSCS protected - up to 100% of value

• FSCS protection for your savings in the unlikely event that we, or one of our money managers, fails. Due to the structure of our investments your pension savings are protected through a contract of long-term insurance up to 100% of their value once fully invested with us, unlike some providers where your pension’s only protected up to £85,000.

It’s quick and easy to get started - sign up in the app

• Sign up in minutes for free

• Tell us about your pensions by sharing your provider name or policy number, then confirm your transfer

• We’ll reach out to your provider to transfer your pension and keep you updated.

PensionBee’s authorised and regulated by the Financial Conduct Authority.

As with any investment, the value of your PensionBee pension can go down as well as up and you may get back less than you started with.

Apr 18, 2024

Version 1.30.4

In this release, we have updated the personal contribution limits to match the new tax year limits and fixed a few minor bugs.

If you have any feedback, let us know at feedback@pensionbee.com

About PensionBee: Combine Pensions

PensionBee: Combine Pensions is a free app for iOS published in the Accounting & Finance list of apps, part of Business.

The company that develops PensionBee: Combine Pensions is PensionBee. The latest version released by its developer is 1.30.4.

To install PensionBee: Combine Pensions on your iOS device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2024-04-18 and was downloaded 2 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the PensionBee: Combine Pensions as malware if the download link is broken.

How to install PensionBee: Combine Pensions on your iOS device:

- Click on the Continue To App button on our website. This will redirect you to the App Store.

- Once the PensionBee: Combine Pensions is shown in the iTunes listing of your iOS device, you can start its download and installation. Tap on the GET button to the right of the app to start downloading it.

- If you are not logged-in the iOS appstore app, you'll be prompted for your your Apple ID and/or password.

- After PensionBee: Combine Pensions is downloaded, you'll see an INSTALL button to the right. Tap on it to start the actual installation of the iOS app.

- Once installation is finished you can tap on the OPEN button to start it. Its icon will also be added to your device home screen.